La calidad del producto es un desafío clave para diversificar las cadenas de suministro

En la búsqueda de diversificar sus cadenas de suministro, las empresas se enfrentan a un desafío crítico: garantizar la calidad del producto. Datos recientes revelan que a medida que las empresas amplían la geografía de sus proveedores, a menudo luchan con tasas más altas de defectos del producto.

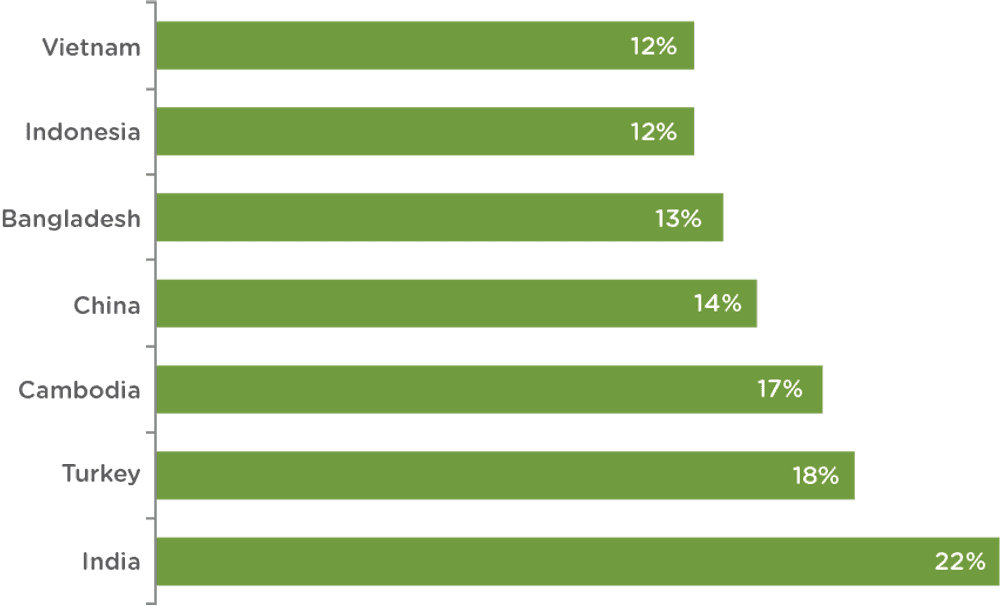

Algunos países, como India, tienen tasas más altas de defectos del producto que otros. Sin embargo, tanto los centros de abastecimiento establecidos como los mercados de proveedores menos maduros pueden presentar desafíos de calidad del producto. Los fabricantes que navegan decisiones de abastecimiento deben priorizar medidas de control de calidad estrictas para mantener la integridad del producto y cumplir con las especificaciones del cliente al diversificar sus cadenas de suministro.

Para las empresas que buscan diversificar sus cadenas de suministro, garantizar la calidad del producto sigue siendo una preocupación principal

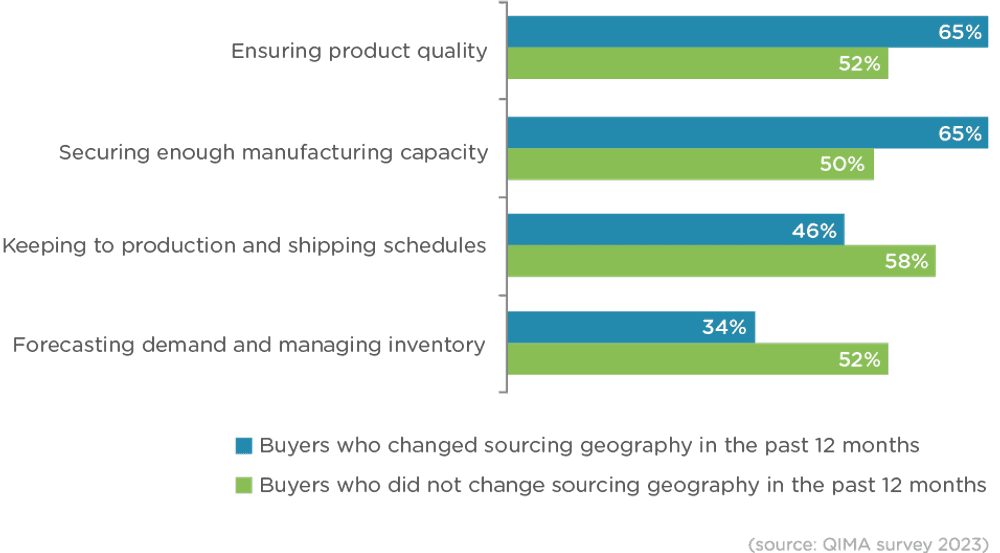

A medida que las empresas diversifican su base de proveedores para mitigar riesgos y optimizar sus operaciones, la importancia de mantener la integridad del producto sigue siendo una preocupación central. De los encuestados de QIMA, el 65 % de los compradores que cambiaron la geografía de abastecimiento en los últimos 12 meses nombraron garantizar la calidad del producto como un desafío principal de abastecimiento (en comparación con solo el 52 % de los compradores que no cambiaron la geografía del abastecimiento).

Figura 1. Principales desafíos de abastecimiento nombrados por los encuestados de QIMA a nivel mundial

A pesar de los desafíos compartidos de la cadena de suministro, las principales preocupaciones de abastecimiento de los compradores que diversificaron sus proveedores son distintas de las de aquellos que mantuvieron sus proveedores existentes. La mayoría de los compradores que diversificaron sus proveedores en el último año se centran en garantizar la calidad del producto y asegurar una capacidad de fabricación adecuada. En contraste, los compradores que no han cambiado su geografía de abastecimiento en los últimos 12 meses expresan diferentes prioridades: programación y gestión de inventarios. Por ejemplo, el 52 % de los compradores que no cambiaron su abastecimiento reportan la previsión de la demanda y la gestión de inventarios como un desafío de abastecimiento principal, en comparación con solo el 34 % de los compradores que sí diversificaron. Esto subraya la necesidad de estrategias de cadena de suministro personalizadas para cumplir con prioridades evolutivas.

La diversificación de la cadena de suministro impacta las tasas de defectos del producto en todas las regiones

La calidad del producto en los países de aprovisionamiento puede diferir significativamente. Generalmente, los mercados de proveedores menos maduros tienden a exhibir tasas más altas de defectos, a menudo quedando fuera de los Límites de Calidad Aceptable (AQL)

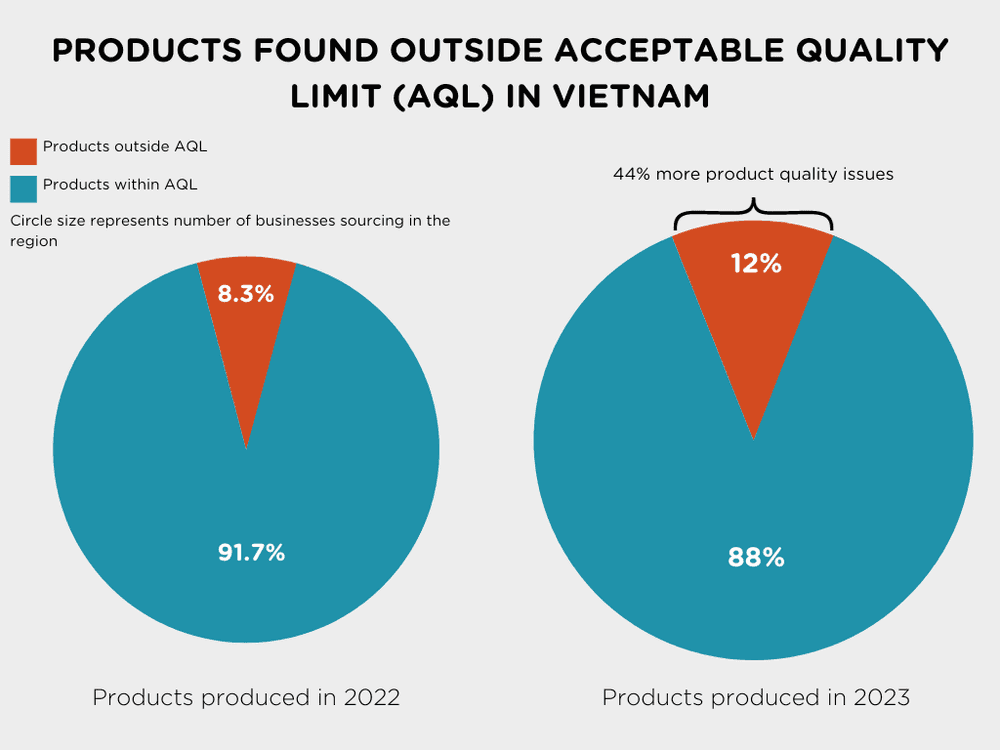

Sin embargo, incluso los centros de aprovisionamiento establecidos pueden enfrentar desafíos de calidad cuando experimentan un aumento en los nuevos negocios. Por ejemplo, Vietnam, tradicionalmente un fuerte competidor, vio un aumento del 44% año tras año en las tasas de "más allá de AQL" en los primeros nueve meses de 2023, lo que indica una caída en la calidad del producto. La tendencia se extiende a mercados de nearshoring como México, donde un considerable aumento de negocios de EE. UU. llevó a un incremento de más del doble en los defectos de productos durante el mismo período en 2023 en comparación con el año anterior.

A medida que las empresas continúan diversificando sus cadenas de suministro, podemos esperar que las tasas de calidad del producto fluctúen en los mercados. Los datos de QIMA revelan un escenario complejo donde tanto los mercados de abastecimiento establecidos como los menos maduros enfrentan problemas de calidad del producto, destacando la interrelación intrincada de factores que afectan el control de calidad. India lidera con el porcentaje más alto de productos encontrados fuera de AQL, seguida de Turquía, Camboya, China, Bangladesh, Indonesia y Vietnam, cada uno mostrando tasas variables de productos que no cumplen con las especificaciones del cliente.

Figura 2: Porcentaje de productos encontrados fuera de los Límites de Calidad Aceptable, enero - septiembre de 2023 (un valor más bajo indica una mejor calidad del producto)

Figuras clave

La encuesta de QIMA a más de 250 empresas muestra que:

La calidad del producto es un desafío clave para diversificar las cadenas de suministro: El 65 % de los compradores que cambiaron la geografía de abastecimiento en los últimos 12 meses mencionaron la garantía de la calidad del producto como un desafío principal de abastecimiento. El 65 % de los compradores que cambiaron la geografía de abastecimiento también enfatizaron asegurar suficiente capacidad de fabricación como una preocupación importante.

Los compradores que no cambiaron la geografía de abastecimiento tienen diferentes prioridades: El 58 % mencionó cumplir con los horarios de producción y envío, y el 52 % identificó la previsión de la demanda y la gestión de inventarios como preocupaciones clave.

La diversificación de la cadena de suministro puede llevar a fluctuaciones en las tasas de defectos del producto entre los proveedores: Si bien los mercados menos maduros tienden a tener tasas más altas de defectos del producto, los mercados establecidos también pueden tener altos defectos del producto si están "sobrecargados" con nuevos negocios.

En los primeros nueve meses de 2023, las tasas de "más allá de AQL" aumentaron un 44 % año tras año en Vietnam a medida que más empresas comenzaron a abastecerse en la región.

Figura 3: Porcentaje de productos encontrados fuera de los Límites de Calidad Aceptable, enero - septiembre de 2023 (un valor más bajo indica una mejor calidad del producto)

Related Articles