Crecimiento del Nearshoring en México: México supera a China como principal socio comercial de EE.UU

La tendencia hacia el nearshoring está ganando impulso, con más de la mitad de las empresas establecidas en EE.UU. y la UE mostrando interés en trabajar con proveedores cercanos. En 2023, México ha emergido como el mayor socio comercial de EE.UU. en 2023, superando a China. En el tercer trimestre de 2023, la demanda de compradores estadounidenses por auditorías e inspecciones en México mostró un destacado crecimiento interanual del +17%. Una creciente preferencia por el nearshoring hacia México está remodelando el panorama para los compradores estadounidenses, ofreciéndoles una mejor confiabilidad y agilidad en la cadena de suministro, potencialmente reduciendo los tiempos de entrega y los costos de transporte, mientras se promueve la cooperación económica con un vecino cercano.

Compradores de EE.UU. Prioritizan la Manufactura en México vs. China

México ha superado a China como el mayor socio comercial de EE.UU. en 2023, con la demanda de auditorías e inspecciones viendo un crecimiento de dos dígitos. Mientras tanto, el crecimiento de la obtención de suministros en China ha sido lento desde 2019. Solo recientemente, en el tercer trimestre de 2023, la participación relativa de China en las carteras de proveedores de los compradores de EE.UU. aumentó, representando el primer incremento desde el inicio de la pandemia de COVID-19.

A partir de julio de 2023, México representó 15% de las importaciones estadounidenses, mientras que China representó el 14,6%.

México ha estado atrayendo nuevos negocios a un ritmo impresionante; según algunas estimaciones, el espacio industrial de México ha crecido un 30% desde 2019. México ofrece muchos beneficios a los compradores basados en EE.UU., como proximidad geográfica, aranceles cero, bajos costos laborales y una base de manufactura relativamente madura. Comprar desde México también permite a las marcas americanas reducir riesgos acortando sus cadenas de suministro.

Sin embargo, al igual que en cualquier otra región, obtener suministros desde México también presenta algunos desafíos, incluyendo infraestructura, disponibilidad de energía y seguridad.

En los próximos años, es probable que las marcas de EE.UU. sean testigos de transformaciones significativas en sus estrategias de obtención de suministros. A medida que el nearshoring hacia México continúa expandiéndose, los compradores estadounidenses deberán abordar los desafíos mencionados anteriormente para capitalizar plenamente las ventajas que este cambio estratégico ofrece.

Lea más sobre la historia, beneficios y desafíos del nearshoring en México en nuestro Documento técnico: Nearshoring en México para Marcas de EE.UU: Ventajas y Desafíos

El Nearshoring Gana Impulso Global

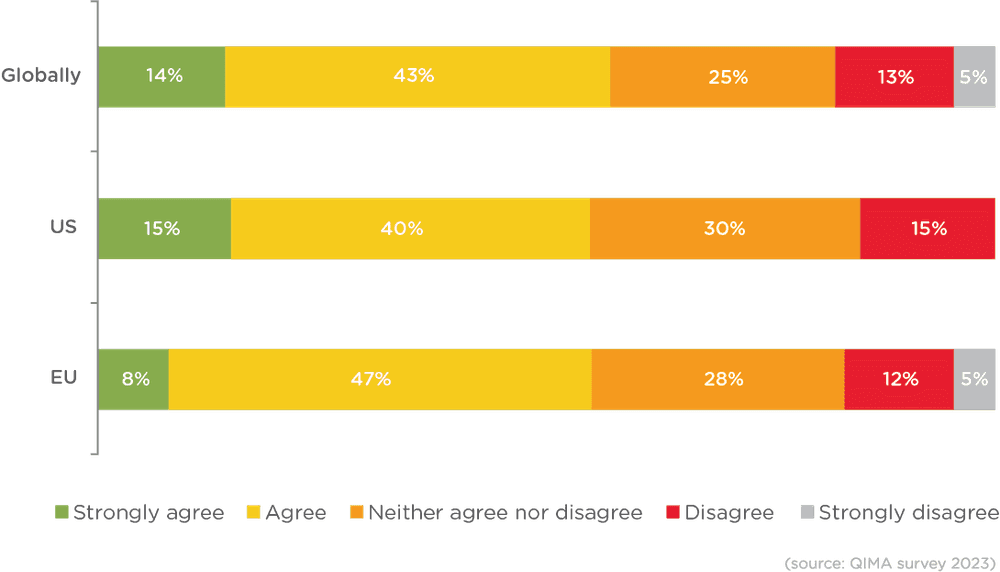

Este cambio hacia la obtención de suministros en México es parte de una tendencia global más amplia a medida que más empresas recurren al nearshoring en lugar de buscar en países más lejanos. A nivel mundial, más de la mitad (57%) de las empresas encuestadas por QIMA informaron que el nearshoring es una parte clave de su estrategia de cadena de suministro en 2023 y más allá.

Figura 1. “¿Se incluye el nearshoring como parte de su estrategia de cadena de suministro a corto y mediano plazo?”

Las empresas de todo el mundo están alejándose cada vez más de obtener suministros en países lejanos y en cambio están recurriendo a destinos de suministro más cercanos a su casa.

Figuras clave

La encuesta de QIMA a más de 250 empresas muestra que:

Fuerte crecimiento en la demanda de auditorías e inspecciones en México: En el tercer trimestre de 2023, la demanda de los compradores estadounidenses por auditorías e inspecciones en México exhibe un crecimiento interanual significativo del +17%.

Impresionante crecimiento industrial: El espacio industrial de México se ha expandido aproximadamente un 30% desde 2019, reflejando su atractivo para los compradores basados en EE.UU.

La tendencia del nearshoring gana impulso: El 57% de las empresas establecidas en EE.UU. y la UE consideran el nearshoring un elemento clave de su estrategia de cadena de suministro, reflejando una tendencia global más amplia hacia la obtención de suministros de proveedores cercanos.

Related Articles