La subcontratación en los mercados nearshore compite con los proveedores del extranjero

Las prácticas de nearshoring y reshoring han ganado terreno constantemente en los últimos años, con compradores basados en la UE y EE.UU. invirtiendo en proveedores más cercanos a casa. Comprender estos cambios en las tendencias de la cadena de suministro y el mercado de proveedores globales es vital para tomar decisiones informadas sobre las prácticas de abastecimiento de su empresa.

Una Tendencia Creciente del Abastecimiento Cercano

En las últimas décadas, los proveedores chinos y del sur de Asia han sido los principales proveedores para empresas basadas en EE.UU. y la UE. Sin embargo, los datos de auditoría de QIMA de 2023 mostraron un aumento notable en la participación relativa de las respectivas regiones de nearshoring y reshoring de los compradores de EE.UU. y la UE, con estos mercados representando ahora el 10% de sus adquisiciones.

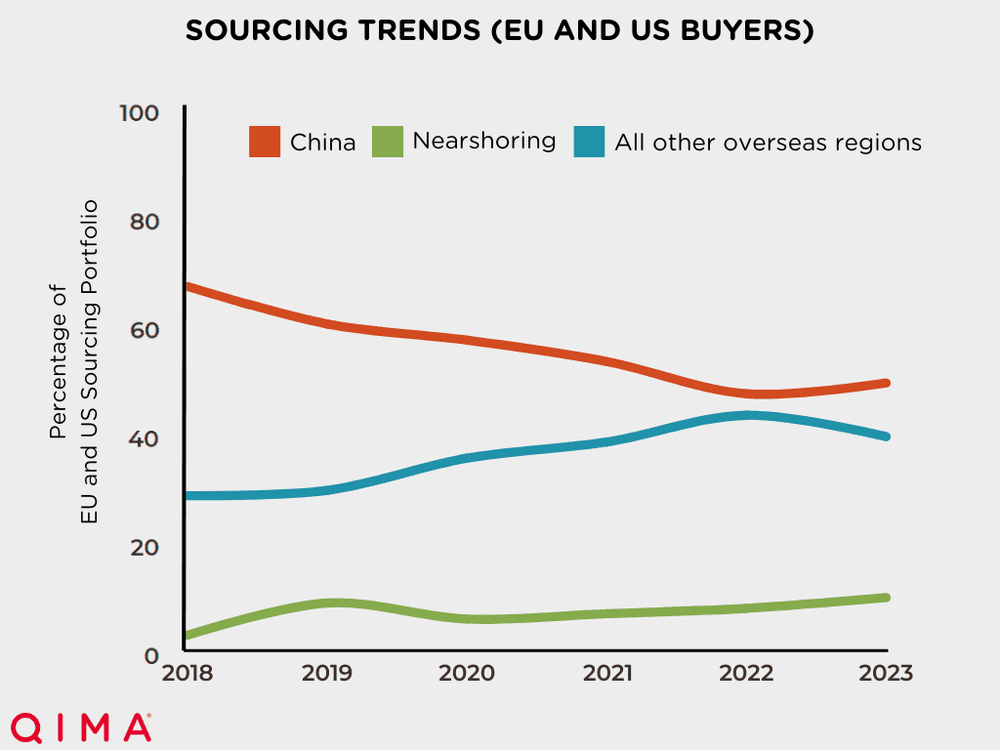

Figura 1. Tendencias de abastecimiento de compradores de la UE y EE.UU. a lo largo del tiempo. Una encuesta de más de 800 empresas reveló que los compradores de la UE y EE.UU. están comenzando a reducir la compra en el extranjero a favor del nearshoring.

Las prácticas de nearshoring han aumentado constantemente desde 2020, ya que los compradores de la UE y EE.UU. desplazan sus prácticas de abastecimiento lejos de los proveedores en el extranjero. En 2023, las demandas de inspecciones y auditorías en México aumentaron un 16% interanual (YoY), superando a China para convertirse en el principal socio comercial de EE.UU.

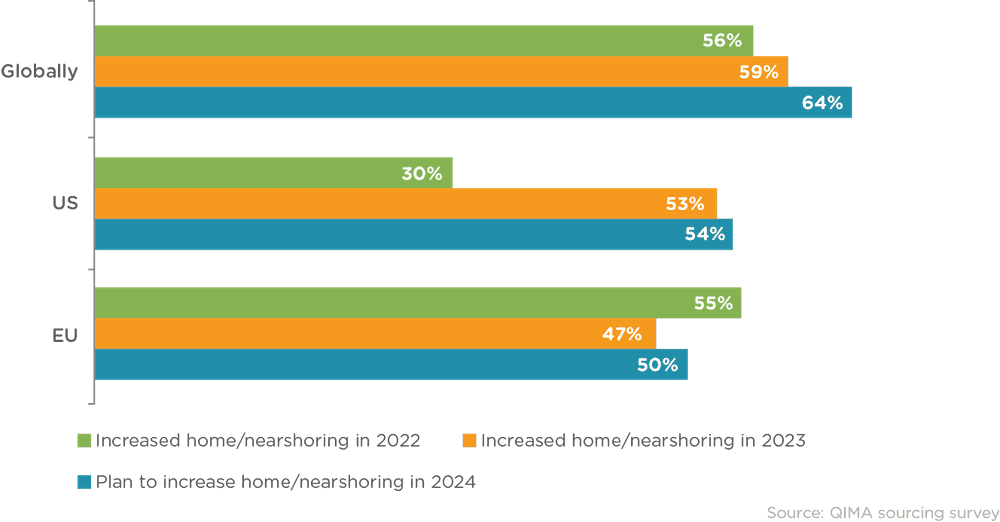

Se espera que estas tendencias continúen en los próximos años. Una encuesta de QIMA de más de 800 empresas con cadenas de suministro internacionales revela que el 54% de los encuestados de EE.UU. y el 50% de los de la UE planean aumentar sus prácticas de abastecimiento de proveedores en sus regiones de origen y cercanas en 2024. Esta encuesta indica las crecientes inversiones en las prácticas de nearshoring y reshoring entre los compradores basados en EE.UU. y la UE, especialmente con el aumento de las tensiones geopolíticas entre EE.UU. y China.

Figura 2. Evolución del interés de los compradores en nearshoring y reshoring, 2022 - 2024, por ubicación de la sede de los encuestados. Los mercados globales han incrementado gradualmente sus prácticas de nearshoring y reshoring desde 2022, con planes de aumentar aún más en 2024.

El Nearshoring Desvía los Volúmenes de Compra de los Mercados en el Extranjero

El impulso hacia el nearshoring y reshoring sugiere un cambio estratégico en los mercados globales que puede afectar a los proveedores del sur de Asia. A medida que el interés por los proveedores cercanos aumenta, el sur de Asia experimentó una disminución del 4% interanual en adquisiciones. Bangladesh e India, que históricamente han sido grandes proveedores para los compradores de la UE y EE.UU., también vieron una desaceleración en las expansiones comerciales en 2023.

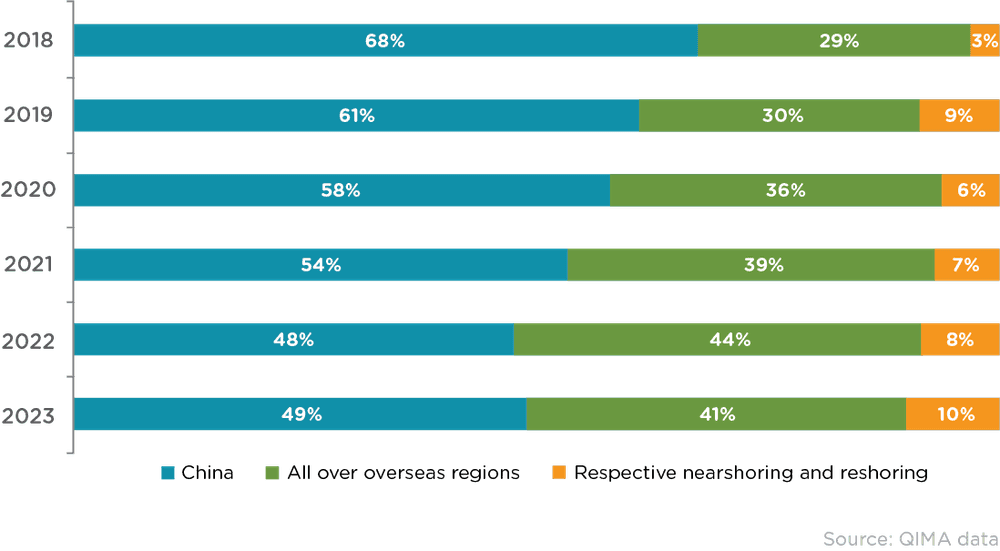

Según los datos de QIMA, las demandas de auditoría en todas las regiones extranjeras—con la excepción de China—disminuyeron un 3% interanual de 2022 a 2023, mientras que las respectivas prácticas de nearshoring y reshoring para compradores de la UE y EE.UU. aumentaron un 2% interanual.

Este cambio lejos de los proveedores en el extranjero puede ser el resultado de que las naciones en desarrollo tienen dificultades para cumplir con las demandas de cumplimiento ético, que son cada vez más importantes para mantener la diligencia debida ESG. Muchos compradores de la UE y EE.UU. están bajo demandas regulatorias, así como expectativas de las partes interesadas, que impulsan sus prácticas de abastecimiento hacia proveedores cercanos, que generalmente están mejor equipados para cumplir con los estándares de cumplimiento ESG que los proveedores en naciones en desarrollo en el extranjero.

Figura 3. Participación relativa de las regiones extranjeras y de origen en compras para compradores basados en EE.UU. y la UE. El aprovisionamiento con nearshoring y reshoring para compradores occidentales ha aumentado constantemente desde 2018, con 2023 mostrando una disminución notable en la compra de todas las regiones extranjeras, con la excepción de China.

A medida que el panorama económico global evoluciona, el desplazamiento hacia el nearshoring y reshoring está reformulando las estrategias de compra de los compradores occidentales. Estos cambios en las tendencias de abastecimiento probablemente se deban al creciente número de regulaciones ESG, impulsando a las prácticas de abastecimiento occidentales lejos de los proveedores en el extranjero. A medida que las empresas adaptan sus estrategias de abastecimiento a un panorama de cadena de suministro global cambiante, el nearshoring y reshoring están preparados para desempeñar un papel crítico en la definición del futuro del abastecimiento global.

Figuras clave

Los datos de auditoría e inspección de QIMA de 2023 muestran:

Los compradores de EE.UU. y la UE están avanzando hacia prácticas de nearshoring y reshoring: Un crecimiento interanual del +2% en compras de nearshoring de compradores occidentales de 2022 a 2023 es parte de una tendencia continua de desplazarse hacia el abastecimiento de regiones locales y vecinas.

Las regiones locales y vecinas representan competencia para los mercados extranjeros: México superó a China como el principal socio comercial de EE.UU. en 2023, con un aumento del 16% en la demanda de inspecciones y auditorías.

El aprovisionamiento de los mercados del sur de Asia disminuye a medida que las tendencias de nearshoring aumentan: El sur de Asia experimentó una caída en las actividades de aprovisionamiento en 2023, con la demanda de inspecciones y auditorías revirtiendo a los niveles de aprovisionamiento de 2021.

Leer el informe completo: Q1 2024 Barómetro

Related Articles