Tendencias cambiantes en el aprovisionamiento de la cadena de suministro: Crecimiento en China ralentizado mientras el sudeste asiático se eleva

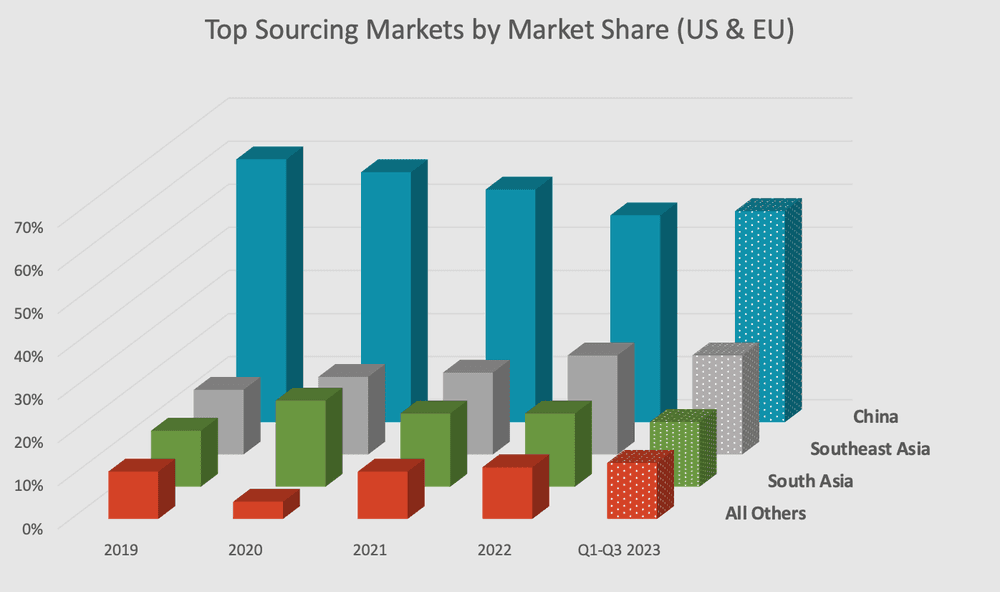

Las empresas de la UE y EE.UU. que obtienen productos en Asia están aumentando cada vez más su alejamiento de China hacia el sudeste asiático. En 2023, la participación de China en el mercado de adquisición de la UE y EE.UU. disminuyó en un 14 % mientras que el sudeste asiático experimentó el mayor crecimiento desde 2019. Se espera que esta tendencia continúe.

Se espera que el cambio hacia el sudeste asiático reconfigure las operaciones futuras de la cadena de suministro para las empresas occidentales, ofreciendo un panorama de adquisición más diverso y flexible, mientras mitiga los riesgos asociados con la dependencia excesiva de un solo mercado.

La adquisición en China sigue siendo fuerte, pero el crecimiento se desacelera mientras el sudeste asiático gana impulso entre los compradores occidentales

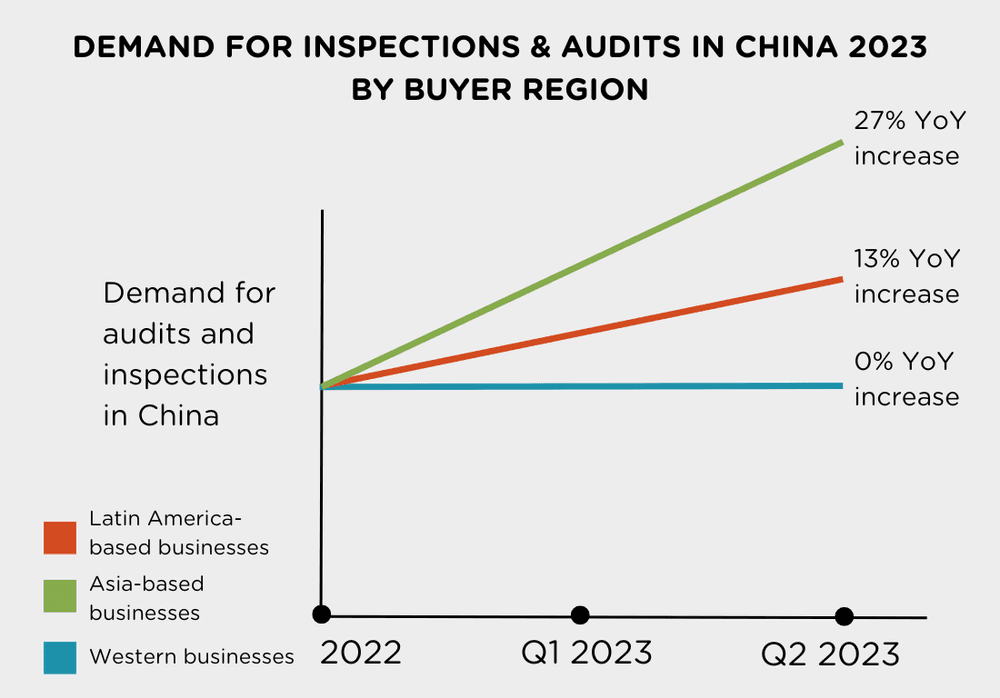

Aunque el crecimiento de China se ha desacelerado, la demanda de adquisiciones allí sigue siendo fuerte. Las empresas en regiones emergentes como América Latina y otras partes de Asia dependen cada vez más de los proveedores chinos. La demanda de las empresas latinoamericanas de auditorías e inspecciones de proveedores chinos creció un 13 % en el segundo trimestre de 2023; la demanda de las empresas con sede en Asia creció un 27 %.

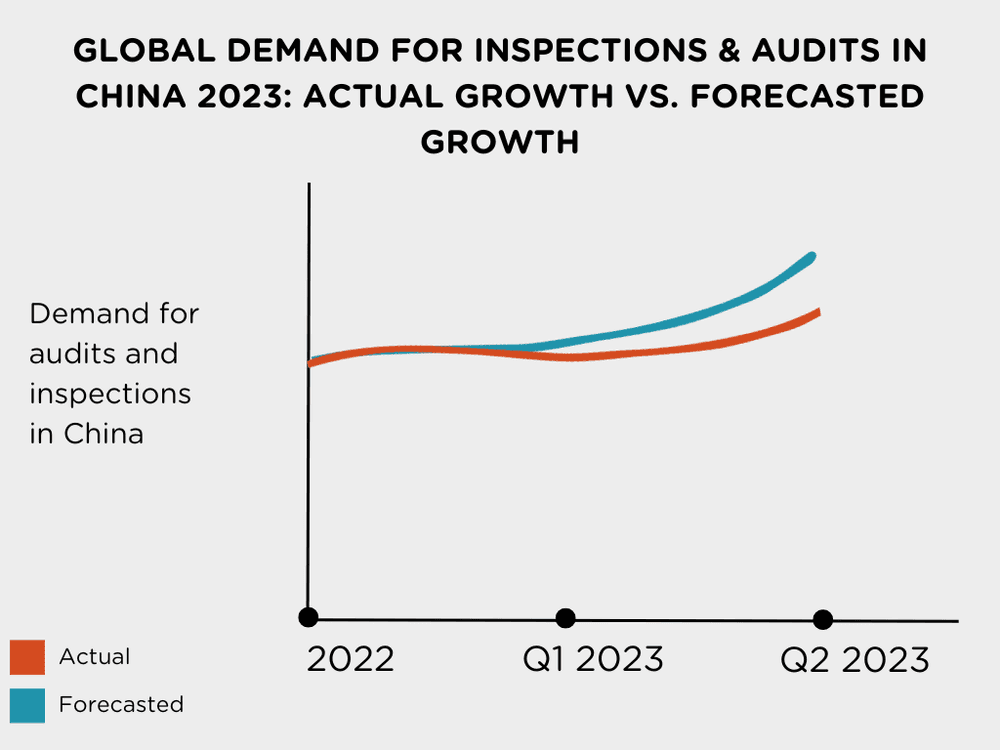

Sin embargo, el crecimiento de adquisiciones en China todavía es más lento que en años anteriores para los compradores de EE.UU. y la UE. Las adquisiciones occidentales en China han estado creciendo solo un 3,5 %, en comparación con las previsiones de 5,6 % (una tasa de crecimiento 36 % más baja de lo esperado).

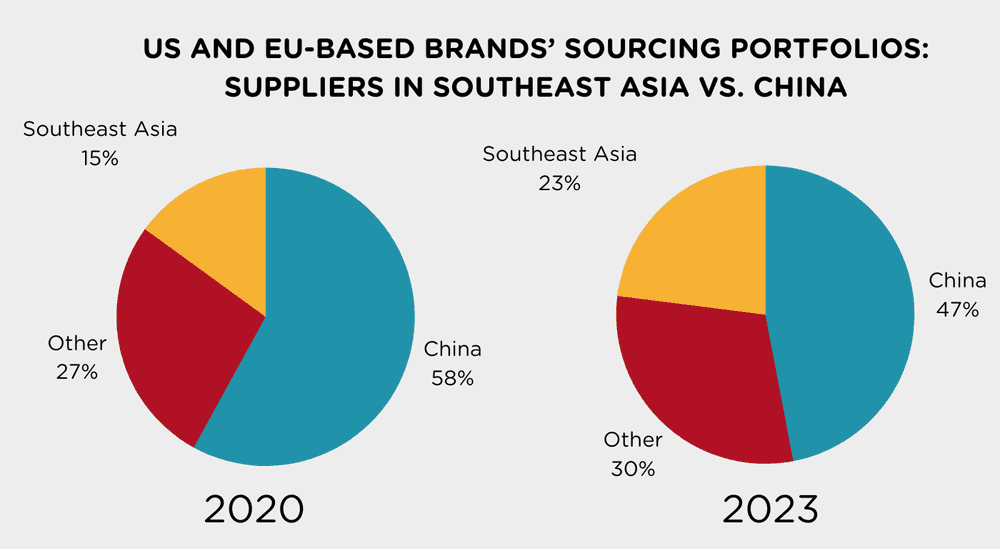

El lento crecimiento de China puede atribuirse, en parte, al creciente dominio del sudeste asiático como un mercado de adquisición en los portafolios de compra de las marcas con sede en EE.UU. y la UE. El sudeste asiático muestra prometedoras expectativas como un jugador emergente en la adquisición de la cadena de suministro, con una creciente demanda de inspecciones y auditorías.

Este cambio hacia la ascendencia del sudeste asiático como un mercado de adquisición promete una mayor diversificación para los compradores occidentales. Las empresas pueden explorar un panorama de adquisición más versátil, reduciendo el riesgo asociado con la dependencia excesiva de un solo mercado.

A medida que nos acercamos a las fiestas, los datos del cuarto trimestre de QIMA muestran un posible cambio de vuelta hacia China como un proveedor clave para los compradores de EE.UU. y la UE en 2023. Por primera vez desde 2019, la participación relativa de China en sus portafolios de proveedores ha aumentado. Este resurgimiento es particularmente notable en el sector textil y de confección, con un aumento significativo en la demanda de inspecciones y auditorías en China, lo que sugiere un renovado énfasis en aprovechar las capacidades bien establecidas de fabricación de China. Esto puede ser en respuesta a las preocupaciones sobre la desaceleración de la economía occidental, motivando a las empresas a recurrir a China nuevamente como proveedor para aprovechar al máximo sus fuertes capacidades de fabricación.

Fig. 1. Mercados principales de adquisición de los compradores de EE.UU. y la UE por participación

El aprovisionamiento de la UE y EE.UU. en países asiáticos además de China está creciendo, con el sudeste asiático viendo el mayor crecimiento desde 2019. Desde 2019, las participaciones de China en los portafolios de compra de EE.UU. y la UE han disminuido un 14 % a medida que otras regiones se vuelven destinos de adquisición más populares.

Sin embargo, las tasas de crecimiento varían por toda la región. El crecimiento del aprovisionamiento de Vietnam en el primer semestre de 2023 quedó rezagado respecto a algunos países vecinos del sudeste asiático debido a obstáculos burocráticos de una campaña anticorrupción y recientes cortes de energía, con datos del segundo trimestre de 2023 mostrando solo una expansión global interanual del +6 % en la demanda de inspecciones y auditorías para proveedores en Vietnam.

Figuras clave

La encuesta H1 de QIMA a más de 250 empresas muestra que:

1. Crecimiento lento de la adquisición en China: La demanda global de inspecciones y auditorías para proveedores en China aumentó un 3,5 % interanual en el segundo trimestre de 2023, detrás de la previsión de crecimiento revisada de China para 2023 del 5,6 %. Esto muestra que la adquisición de la cadena de suministro en China todavía está creciendo, pero desacelerándose.

Fig. 2. Crecimiento previsto versus crecimiento real de la demanda de adquisición en China en 2023

2. Las regiones emergentes son la razón del crecimiento de la adquisición de la cadena de suministro en China: La demanda de proveedores chinos crece entre las empresas de América Latina y Asia, mientras que la demanda de proveedores chinos entre las empresas occidentales se mantiene plana.

La demanda de las empresas con sede en América Latina de auditorías e inspecciones para proveedores en China aumentó un 13 % interanual en el segundo trimestre de 2023 en comparación con la demanda plana de los compradores occidentales en el mismo período.

La demanda de inspección y auditoría de empresas con sede en Asia para proveedores en China vio un 27 % de aumento interanual en el segundo trimestre de 2023.

Fig. 3. Demanda de adquisición en China medida por órdenes de auditoría e inspección (por región del comprador)

3. Los compradores de EE.UU. y la UE recurren a la adquisición en el sudeste asiático: La participación combinada de los mercados de adquisición del sudeste asiático en los portafolios de compra de las marcas con sede en EE.UU. y la UE ha estado creciendo constantemente, y en el primer semestre de 2023 representó casi la mitad de la de China (en comparación con un tercio en 2020).

Fig. 4. Portafolios de los compradores con sede en EE.UU. y la UE por región de adquisición

Leer el informe completo: Q3 2023 Barómetro

Related Articles