Empresas en todo el mundo adoptan la sostenibilidad en respuesta a la CSDDD de la UE y otras legislaciones de ESG

En 2023, las empresas están tomando la sostenibilidad más en serio debido a la aprobación de legislaciones ESG como la Ley de la Cadena de Suministro de Alemania y la Directiva de Diligencia Debida Corporativa en Sostenibilidad de la UE (CSDDD). Este cambio no se limita solo a las empresas europeas; a nivel mundial, casi la mitad de las empresas se ven directa o indirectamente afectadas por la legislación ESG y están tomando medidas para mejorar el cumplimiento ESG.

Estas regulaciones están causando un efecto dominó, ya que incluso las empresas fuera del alcance de la legislación ESG están colocando un mayor énfasis en la responsabilidad ambiental, las prácticas laborales justas y el abastecimiento responsable. A medida que las cadenas de suministro se adaptan para alinearse con estos valores ESG, las empresas deben ajustarse rápidamente para mantener su competitividad, adherirse a las regulaciones relevantes y satisfacer las demandas cambiantes de clientes y accionistas.

Cómo la Legislación ESG Está Impactando las Cadenas de Suministro Globales: CSDDD de la UE, la Ley de la Cadena de Suministro de Alemania y Más

Las empresas a nivel mundial están aumentando rápidamente su enfoque en la sostenibilidad en 2023, ya que regulaciones como la Ley de la Cadena de Suministro de Alemania y el CSDDD de la UE entran en vigor. Estas regulaciones están teniendo un “efecto de goteo”, en el que incluso las empresas que no están directamente afectadas por estas regulaciones están prestando más atención a las prácticas ESG.

Alrededor del 47% de las empresas encuestadas por QIMA en todo el mundo declararon que están directa o indirectamente afectadas por la legislación ESG. En la UE, este número es aún mayor, con un 63% de empresas afectadas directa o indirectamente por la legislación ESG, y solo un 23% de empresas no afectadas en absoluto.

El porcentaje de empresas estadounidenses directamente bajo el alcance de la legislación ESG es mayor que en la UE (39% en EE. UU. frente a 21% en la UE). Esto puede deberse a que la legislación relacionada con ESG ha estado en vigor desde hace más tiempo en EE. UU., como la Sección 1502 de la Ley Dodd-Frank, aprobada en 2010. Sin embargo, al considerar tanto las empresas afectadas directa como indirectamente, menos empresas en EE. UU. dicen estar impactadas por la legislación ESG que en la UE.

Asia tiene el porcentaje más bajo de empresas que reportan impactos directos o indirectos de la legislación ESG, con un 44%. Esto se debe probablemente a menores niveles de adopción y aplicación de regulaciones ESG en los países asiáticos, así como a diferentes etapas de conciencia y preparación dentro de la región. Aunque la importancia de los temas ESG está creciendo a nivel mundial, el grado en que afecta a las empresas puede diferir según los paisajes regulatorios regionales y las dinámicas del mercado.

Fig. 1. “¿Se encuentra su empresa dentro del alcance de alguna legislación ESG?” (agrupado por ubicación de la sede central del encuestado)

A nivel mundial, casi la mitad de las empresas encuestadas por QIMA están directa o indirectamente impactadas por la legislación ESG. En la UE, este número es incluso mayor, con un 63% de empresas con sede en la UE cayendo directa o indirectamente en el ámbito de la legislación ESG.

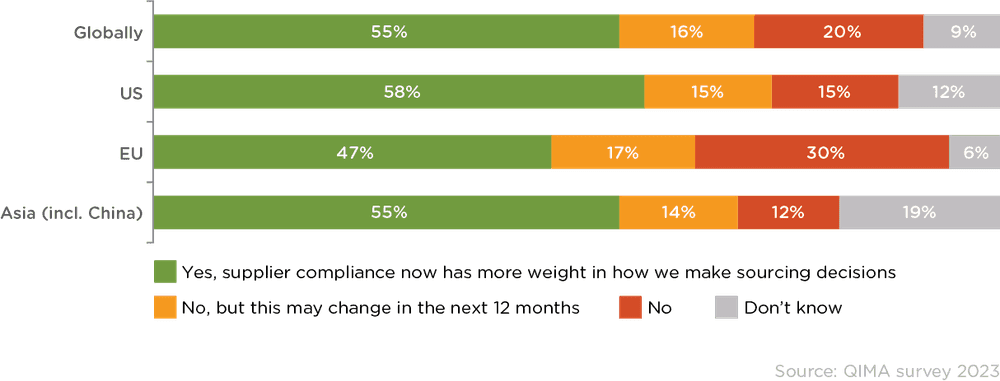

La Legislación ESG Conduce a un Mayor Enfoque en el Cumplimiento del Proveedor

A nivel mundial, más de la mitad de las empresas (55%) están dando voluntariamente más importancia al cumplimiento del proveedor al tomar decisiones de abastecimiento, incluso si no están legalmente obligadas a hacerlo. El cumplimiento del proveedor se reconoce cada vez más como un elemento crucial en el compromiso de las empresas con prácticas responsables y sostenibles. Este cambio muestra que las empresas están decididas a tomar decisiones de abastecimiento que se alineen con las responsabilidades ambientales y sociales, reflejando la creciente influencia de la legislación ESG a lo largo de las cadenas de suministro globales.

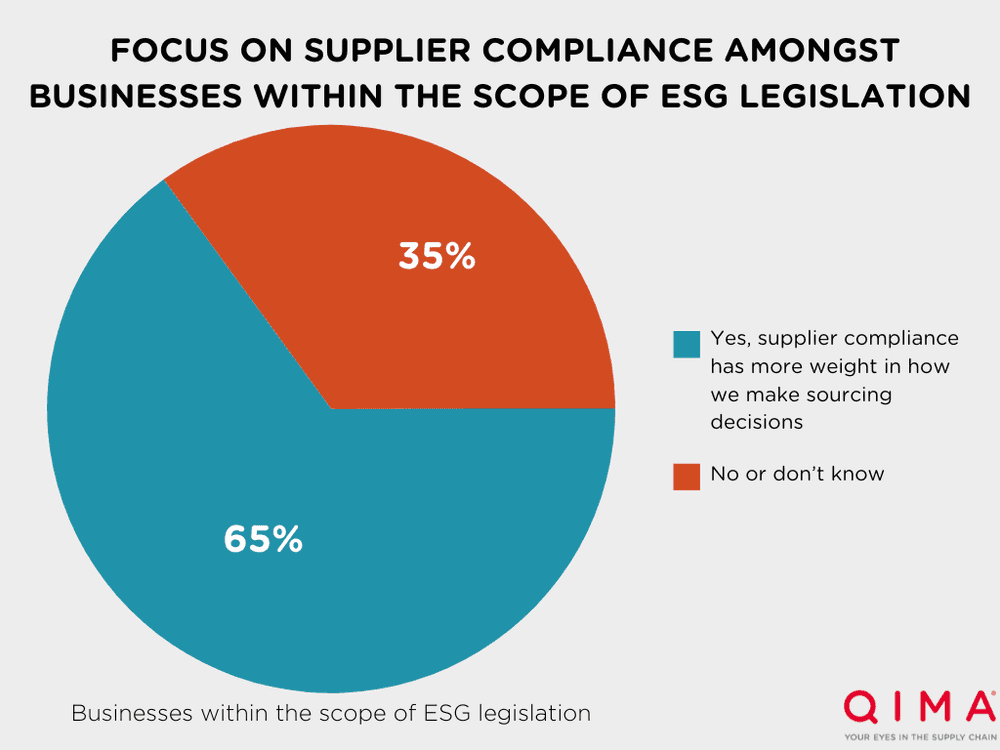

Entre las empresas que están directamente dentro del alcance de la legislación ESG, se presta aún más atención al cumplimiento del proveedor. El 65% de las empresas directamente impactadas por la legislación ESG dicen que el cumplimiento del proveedor tiene un impacto más fuerte en sus decisiones de abastecimiento en 2023 que en 2022.

EE. UU. lidera la tendencia, con un 58% de las empresas estadounidenses poniendo un mayor enfoque en el cumplimiento del proveedor que en el pasado.

Mientras que las empresas basadas en Asia reportan ser las menos impactadas por las regulaciones ESG, un mayor porcentaje de empresas asiáticas están dando más importancia al cumplimiento del proveedor en sus decisiones de abastecimiento que en la UE (55% en Asia frente al 47% en la UE). Esto muestra que puede haber otras fuerzas impulsoras detrás del enfoque aumentado en el cumplimiento del proveedor que el cumplimiento de la legislación ESG. Por ejemplo, las empresas asiáticas podrían estar respondiendo a un escrutinio global intensificado y a la creciente demanda de consumidores para prácticas de abastecimiento éticas y sostenibles, que no solo están impulsadas por mandatos legales sino por un cambio más amplio en las expectativas del mercado.

El enfoque en el cumplimiento del proveedor también varía según la industria. Los sectores con un historial reciente de fuerte escrutinio público, como Textil y Vestimenta, suelen tener el mayor porcentaje de empresas que prestan más atención a la conducta del proveedor en comparación con 2022. Otras industrias con un enfoque más fuerte en el cumplimiento del proveedor en 2023 incluyen productos promocionales, alimentos y calzado. La industria con el menor crecimiento en el enfoque en el cumplimiento del proveedor cuando se trata de decisiones de abastecimiento es la industria de juguetes y productos recreativos.

Fig. 2. “¿El cumplimiento del proveedor tiene un impacto más fuerte en sus decisiones de abastecimiento ahora en comparación con hace 12 meses?” (agrupado por ubicación de la sede central del encuestado, independientemente de si el encuestado está dentro del alcance de la legislación ESG)

En comparación con hace un año, más de la mitad de las empresas encuestadas dicen que el cumplimiento del proveedor tiene un impacto más fuerte en sus decisiones de abastecimiento. En EE. UU., el cumplimiento del proveedor está ganando terreno como impulsor de las decisiones de abastecimiento para el 58% de las empresas.

Figuras clave

La encuesta H1 de QIMA a más de 250 empresas muestra que:

1. Aumento global en el enfoque en el cumplimiento del proveedor: Más de la mitad (55%) de las empresas están dando voluntariamente más peso al cumplimiento del proveedor al tomar decisiones de abastecimiento en comparación con hace un año, incluso si no están legalmente obligadas a hacerlo.

2. Las empresas dentro del alcance de la legislación ESG dan más peso al cumplimiento del proveedor: El 65% de las empresas dentro del alcance de las nuevas regulaciones ESG como el CSDDD de la UE se están enfocando más en el cumplimiento del proveedor en sus decisiones de abastecimiento.

Fig. 3. “¿El cumplimiento del proveedor tiene un impacto más fuerte en sus decisiones de abastecimiento ahora en comparación con hace 12 meses?” (entre empresas directamente dentro del alcance de la legislación ESG)

3. El aumento del escrutinio público lleva a prestar más atención al cumplimiento del proveedor: Los sectores con un historial reciente de fuerte escrutinio público, como Textil y Vestimenta, tienden a tener el mayor porcentaje de empresas que prestan más atención a la conducta del proveedor.

Leer el informe completo: Q3 2023 Barómetro

Related Articles